Baraza is a Swahili word that means a deliberation meeting held by a collective group of people with wisdom.

T : +254 (20) 2243097 / 2227100

Email: info@openbaraza.org

OPENBARAZA

Dew CIS Solutions LTD Barclays Plaza, 12th Floor. Loita Street.

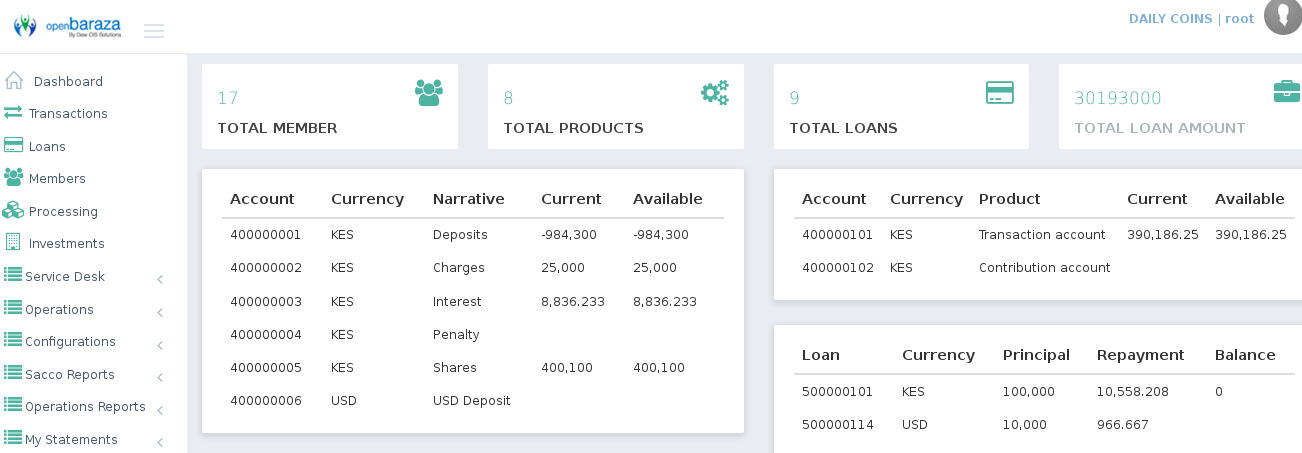

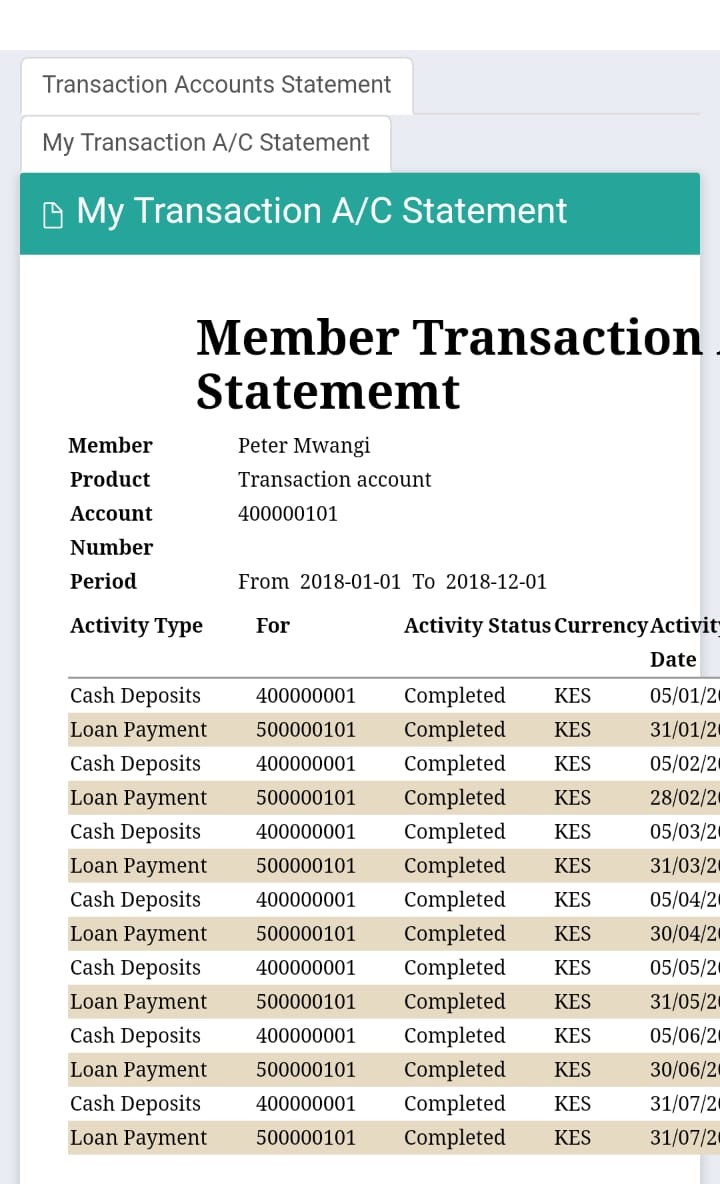

Sacco Management System will search and retrieve a required data instantly.

The Proposed System provides a user-friendly background as well as

user-friendly functions.

For notification purposes.